Should Investors be Worried about the Federal Debt?

June 11, 2021 – Larry Swedroe

Something that everyone knows isn’t worth knowing.

— Bernard Baruch

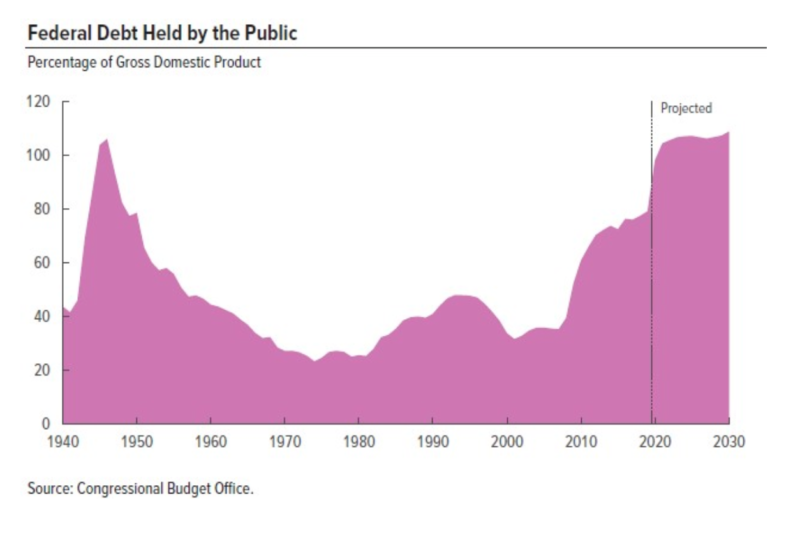

As the chief research officer of Buckingham Wealth Partners, I’ve been getting lots of calls from investors concerned about the rapid growth in US government debt. The concerns are based not only on the current level of debt, which reached a record $28 trillion in March, and the fact that the ratio of total federal debt held by the public to GDP crossed 100 in February, but also on the concerns about the massive continued deficits projected in President Biden’s proposed $6 trillion 2022 budget.

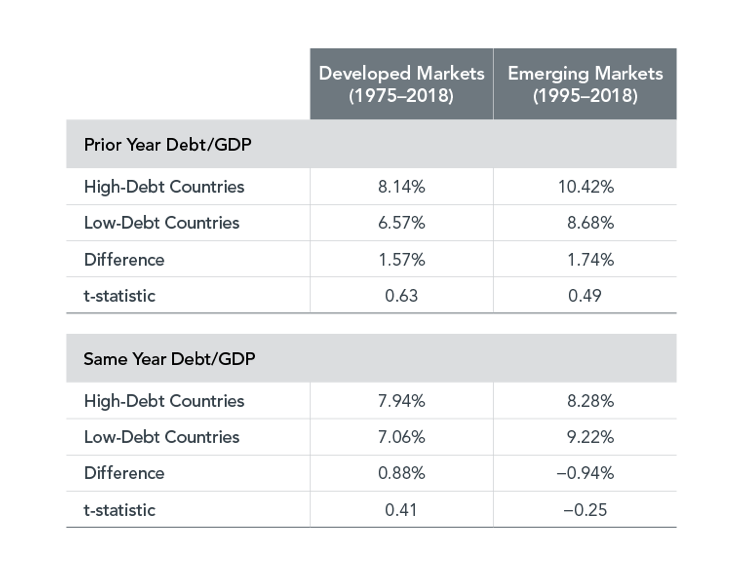

The Congressional Budget Office projects that, unless things change, the ratio will reach 195 percent in 2050. It’s figures such as this that have investors concerned, raising the question of what has been the historical evidence on the impact of high debt-to-GDP ratios on equity returns. Thanks to the research team at Dimensional, we can examine the evidence. In the table below, Dimensional sorted countries each year by their debt-to-GDP ratio.

As you can see, the top panel sorted countries by the prior year ratio and found that average annual equity premiums have been slightly higher in high-debt countries than low-debt countries in both developed and emerging markets. The result should not be unexpected, as it seems likely that investors would view countries with higher debt-to-GDP ratios as riskier and thus demand a risk premium. However, note that the differences were not significant, even at the 10 percent confidence level, suggesting that they are not reliably different from one another.

Since investors may be more focused on where they expect the debt ratio to end up rather than on where it has been, in the bottom panel Dimensional ranked countries on debt-to-GDP at the end of the current year, assuming perfect foresight of end-of-year debt levels. The results were similar in that there was no statistically significant difference in equity premiums between high- and low-debt countries (in developed markets high-debt countries produced somewhat higher returns, while in emerging markets they produced somewhat lower returns). The results imply that markets have generally priced in expectations for future government debt.

The relationship between economic growth and the equity premium

Dimensional also looked at the relationship between economic growth and equity premiums. Contrary to what most investors likely believe, when annual U.S. equity premiums are plotted against GDP growth for the same year, there is no discernible relation between the two — changes in GDP have not been strongly related to simultaneous stock market returns.

The explanation for the lack of a relationship is that markets are forward-looking — because expectations are already embedded in prices, markets react well in advance of when the outcomes are reported. Thus, the eventual direction of the stock market will not depend on the actual outcome. Instead, the eventual direction will depend on how the economic outcome compares to expectations. For example, if things aren’t as bad (good) as expected, poor (good) economic news can be greeted with a positive (negative) stock reaction.

Dimensional concluded: “The results presented here are consistent with markets aggregating and processing vast sets of macroeconomic indicators and expectations for those indicators. By incorporating this information into market prices, we believe public capital markets effectively become the best available leading macroeconomic indicator.”

The takeaway for investors

The lesson for investors is that there is an important distinction between information and value-relevant information (information you should act on because it adds value to your expected returns). A country’s debt-to-GDP ratio, or its expected growth rate, is information but is not value relevant because in both cases the markets are well aware of the same information and thus have already incorporated it into prices. The result is that the only way you can expect to benefit from that information is to somehow interpret it better than the collective wisdom of investors.

The conclusion you should draw is that since the vast majority of trading is done by sophisticated investors, who almost certainly know more than you do about the subject, you should ignore the information you thought was important because it is already embedded in prices through the trading actions of those sophisticated investors.

Important Disclosure: The information contained in this article is for educational purposes only and should not be construed as specific investment, accounting, legal or tax advice. The analysis contained in this article is based upon third party information available at the time which may become outdated or otherwise superseded at any time without notice. Certain third-party information is based upon is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth®, Buckingham Strategic Partners® (collectively Buckingham Wealth Partners). LSR- 21-99

LARRY SWEDROE is Chief Research Officer at Buckingham Strategic Wealth and the author of numerous books on investing.

From time-to-time we share third-party articles/information that may be of interest to our clients. These articles are being provided for informational purposes only, do not constitute investment advice and do not necessarily represent the opinions of Homan Wealth Advisors. Homan Wealth Advisors does not provide any guarantee, expressed or implied, that the information presented is accurate or timely, and does not contain inadvertent technical or factual inaccuracies. The past performance of securities is no guarantee of their future result. The value of any investment may fall, as well as rise, and investors may not receive the full amount of their principal at the time of redemption if asset values have fallen.